- Exness Payment Methods

- Base Currencies in Exness

- How to Make a Deposit at Exness

- Exness Deposit Limits and Fees

- Saved Payment Methods in Exness

- Common Deposit Issues and Solutions

- Withdrawing Funds From Exness

- Exness Withdrawal Limits and Fees

- Exness Common Withdrawal Issues and Solutions

- Security Measures For Financial Transactions

- Tips For Smooth Deposits And Withdrawals

- FAQ

Exness Payment Methods

Exness offers a broad array of deposit and withdrawal options, taking into consideration different tastes and preferences. Bank transfers, credit/debit cards, and different online payment services, including e-wallets, can be used for depositing and withdrawing money. Such options will make your life easy regarding your trading account and irrespective of your geographical location.

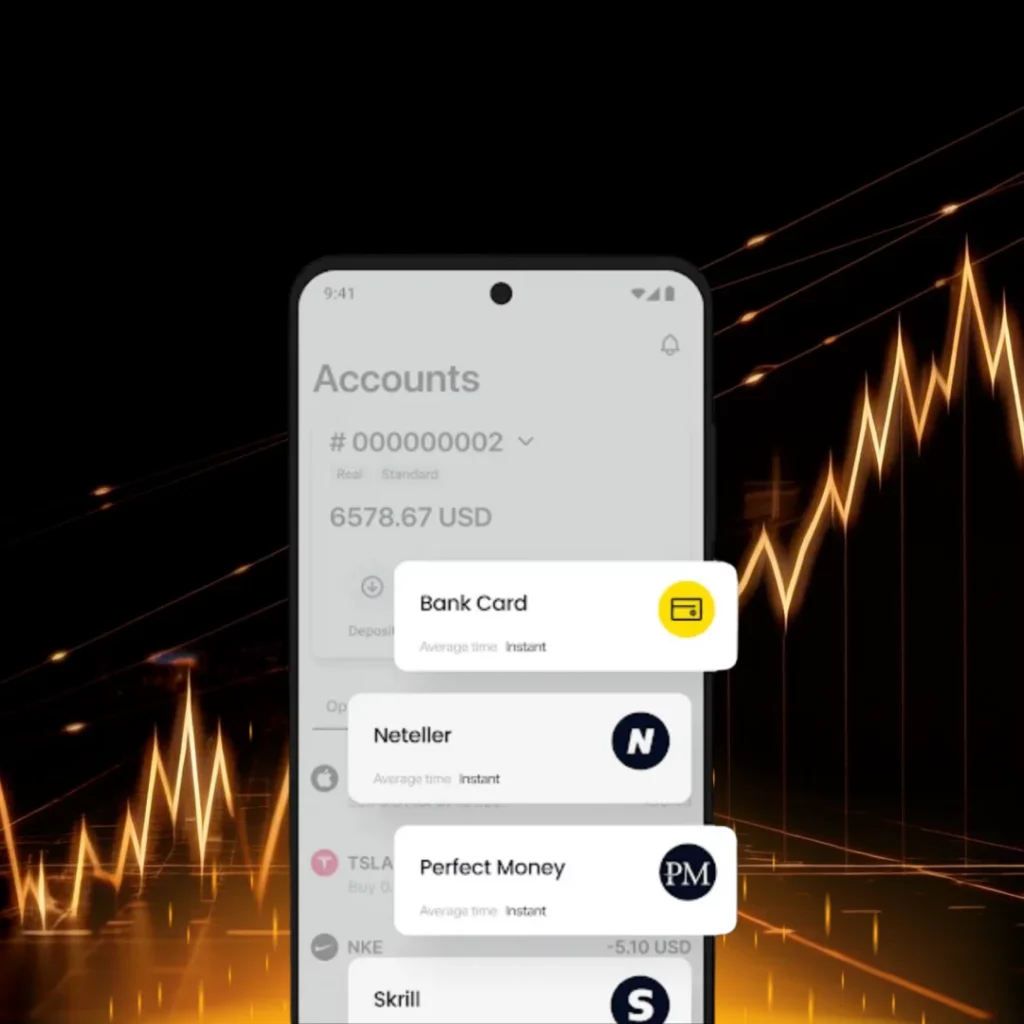

Supported Deposit and Withdrawal Options

Exness supports a wide range of deposit and withdrawal options, which are convenient for traders from all over the world. The most popular means of deposit and withdrawal include credit/debit cards (Visa, MasterCard), bank transfers, and online wallets like Skrill, Neteller, and WebMoney. You can choose your preferred method based on transaction fees, speed, and convenience. Most deposit methods are instant, while withdrawal times may vary depending on the method.

Major Payment Providers

Exness provides a wide selection of payment options through the use of major providers that ensure traders can easily fund their accounts and withdraw their money. The most widely used means of payment methods include bank transfers, suitable for larger amounts but take a few business days in processing, and e-wallets such as Skrill, Neteller, and WebMoney, which offer fast and secure transactions. Credit and debit card payments are also supported through Visa and MasterCard for faster deposits. These options are meant to give traders around the world flexibility in their choices, considering transaction speed and convenience.

Base Currencies in Exness

Exness offers a selection of base currencies to suit traders’ preferences. Your base currency is the currency in which your account balance, profits, and losses are calculated. This currency choice is essential as it determines how your trading account is managed. Common base currencies offered by Exness include USD, EUR, GBP, AUD, JPY, and others. This flexibility thus allows traders from different countries to choose the currency that will best suit their needs and avoid unnecessary conversion costs in trading.

Supported Account Currencies

Exness supports multiple account currencies to cater to global traders. Some of the supported account currencies include:

USC EUC GBC CHC AUC CAC AED ARS AUD AZN BDT BHD BND BRL CAD CHF CNY EGP EUR GBP GHS HKD HUF IDR INR JOD JPY KES KRW KWD KZT MAD MXN MYR NGN NZD OMR PHP PKR QAR SAR SGD THB UAH UGX USD UZS VND XOF ZAR

With these options, you can select the currency that suits your trading style and financial goals. This ensures more convenient deposits, withdrawals, and the ability to avoid high conversion fees.

Choosing Your Base Currency

When opening an account in Exness, one must be very careful in selecting the base currency. It will determine how your profit or loss is calculated, thus selecting the right one can help you manage your trading better. If your local currency is USD, for instance, choosing USD as a base currency will help to avoid conversion fees. Similarly, for traders in Europe, EUR is preferred to make things much easier. Select the base currency with which your local currency is aligned, since this would make transactions easier and cheaper.

How to Make a Deposit at Exness

Deposit on Exness is swift and safe, traders have various means of depositing money into their trading accounts. With instantaneous processing and user-friendly options, you can easily top up your trading account and begin trading in no time.

Step-by-Step Deposit Process

Making a deposit to your Exness account is a simple process. Follow these steps to fund your account:

- Log in to your Exness Personal Area.

- Navigate to the Deposit section.

- Choose your preferred payment method (credit/debit card, e-wallet, bank transfer, etc.).

- Enter the amount you wish to deposit.

- Confirm the transaction and complete any required authentication or verification.

After completing these steps, your deposit will be processed. Most payment methods are instant, and funds will be available in your trading account shortly.

Exness Deposit Confirmation

The payment will be reflected in your account immediately after the successful confirmation from Exness Personal Area, with the status of the transaction indicated as Completed. Depending on the payment method, deposits can take anything from just a few minutes up to a few business days. It is worth taking a moment to double-check whether or not everything went through alright regarding the status of your transaction. Should there be any problems or delays, Exness support will promptly handle everything as soon as possible.

Exness Deposit Limits and Fees

Exness allows its users to deposit funds into their accounts using flexible means, such as credit cards, e-wallets, and bank transfers. For each of these payment options, there is a certain deposit limit and fee, which may vary depending on the country and currency in question. Exness claims to include convenient and low-cost deposit solutions. However, all this information should be carefully checked before funding your account since some limits and commissions may apply.

Minimum and Maximum Deposit Amounts

Exness minimum deposit amounts are very low, starting from just $1 on some payment options. In the case of e-wallets, including Skrill or Neteller, the minimum deposit can be $1, but for bank transfers, this figure can be higher. The maximum deposit may also vary: for credit cards and e-wallets, it is usually higher and can reach several thousand dollars. If you are going to send a large amount, for avoiding any delay or complications in the process of transfer of money, check your respective payment provider’s limits beforehand.

Exness Deposit Fee

Exness does not charge deposit fees. Sometimes, the third-party bank or the e-wallet service charges a fee to deposit money with Exness. For instance, certain e-wallets will levy a small commission to transfer money to your trading account at Exness. Bank transfers, particularly international ones, might involve processing fees. It’s essential to check with your payment provider about any fees before proceeding with a deposit. In most cases, Exness works to minimize any charges, providing traders with affordable and accessible ways to fund their accounts.

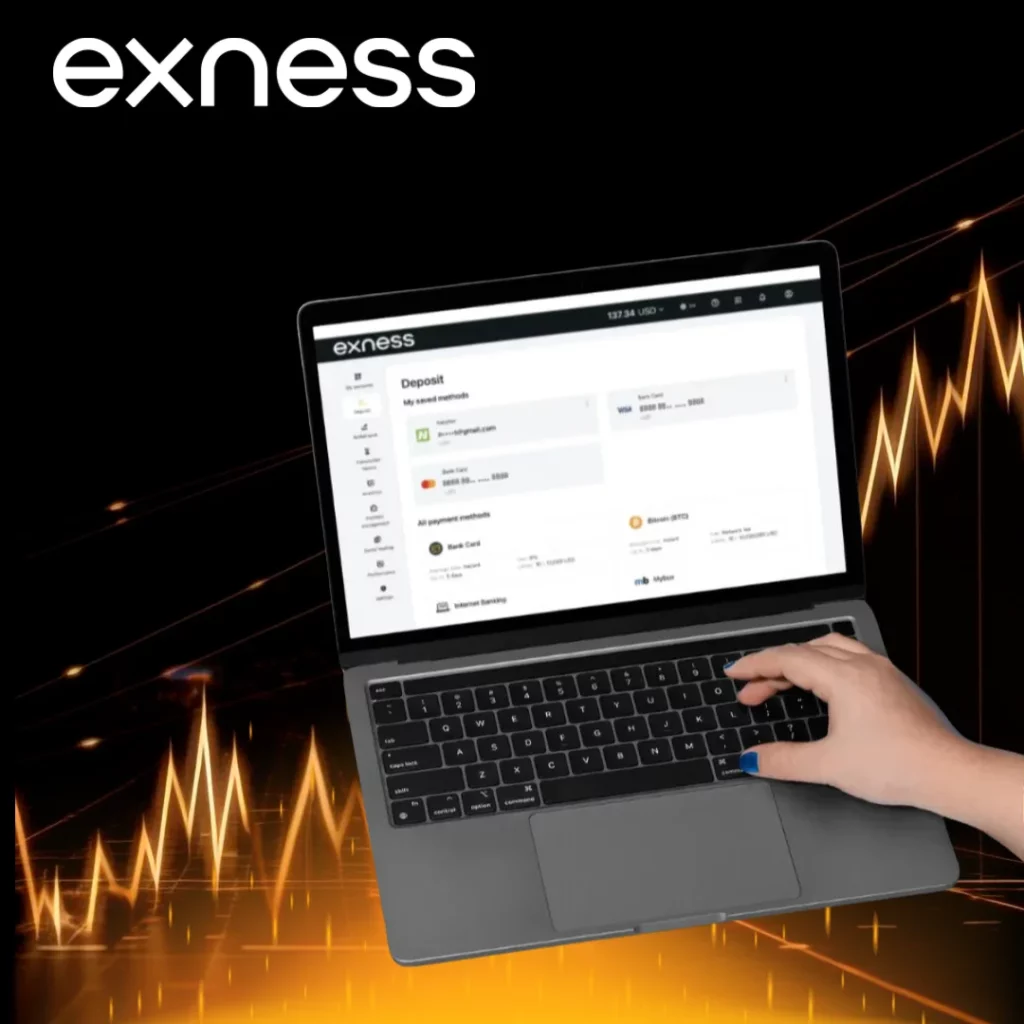

Saved Payment Methods in Exness

Saved payment methods in Exness simplify the deposit and withdrawal process by storing your previously used transaction details. This feature ensures faster and more convenient transactions directly from your Personal Area.

Benefits of Saved Payment Methods

Every successful deposit or withdrawal within your Exness Personal Area will be saved automatically for further usage as a payment method. The system is designed to simplify your process of paying: frequently used methods are easy to access. It will save you time and minimize the risk of errors in inputting transaction details.

Saved methods are especially useful for traders who regularly fund their accounts or withdraw profits, as they provide convenience and ensure seamless transactions.

How to View and Save Payment Methods

To view your saved payment methods:

- Log in to your Personal Area.

- Navigate to the Deposit or Withdrawal tab.

- Your saved methods will appear at the top of the page under My saved methods.

Methods only appear here after you’ve successfully completed at least one transaction using them.

How to Use Saved Payment Methods

Using a saved payment method is straightforward:

- Select the saved method displayed at the top of the Deposit or Withdrawal tabs.

- The transaction screen will appear, with some fields pre-filled for your convenience.

- Complete the transaction by filling in the remaining required details and confirming.

This feature ensures a smooth and quick experience while managing your deposits and withdrawals.

Common Deposit Issues and Solutions

Depositing to your Exness account is usually seamless, but issues like payment failures or delays may occur. Ensure your payment details are correct, the method is supported by Exness, and there are no restrictions from your bank. Slow internet or server issues can also cause delays. If the problem persists, contact Exness support for assistance and verify your account details are accurate.

Currency Conversion Problems

Currency conversion issues can occur when the currency of your deposit method differs from your Exness account’s base currency. Here are some common problems you may face:

- Exchange rate fluctuations: The value of your deposit may change due to exchange rate changes during processing.

- Conversion fees: Some payment methods charge a fee for currency conversion, which can increase the overall cost of the deposit.

- Incorrect amount: The amount you deposit may be incorrectly converted, leading to discrepancies in your account balance.

To avoid these problems, choose a payment method that uses the same currency as your Exness account’s base currency. If you need to make a deposit in a different currency, be aware of potential conversion fees and rates. Double-check your deposit amount to ensure it matches your expectations after conversion.

Common Deposit Solutions

To avoid deposit problems, first of all, make sure that the selected method of payment is accepted by Exness and meets the minimum deposit requirements for your account type. Check that your account details are correctly inputted with your name and payment information matching the details registered with Exness. In case of delays, check with your payment provider if there was any further approval required or if the transaction is restricted in any way. For quicker resolution, log in to the Exness trading platform and verify your transaction status, or contact Exness customer support-24/7-for timely support. Always keep payment receipts on hand for reference during inquiries. These steps ensure a smooth deposit process and minimize disruptions to your trading activities.

Withdrawing Funds from Exness

Withdrawing funds from your Exness account is straightforward and can be done directly from your Exness Personal Area. To start the withdrawal process, log in to your account and proceed to the Withdrawal section. Select your preferred payment method, which can be an e-wallet, credit card, or bank transfer. Type the amount you want to withdraw and confirm the transaction. In some cases, depending on the payment method, verification might be necessary for security reasons. Once you have fulfilled these steps, your withdrawal request will be processed, and the funds will be credited to your chosen method.

Once you have requested a withdrawal, Exness will process it according to the selected payment method. With e-wallets like Skrill or Neteller, the withdrawal time is usually within minutes, which makes them one of the fastest options. Transfers to banks take a few business days because of the processing time through financial institutions. Note that the time of withdrawal can also be different depending on the sum and verification status of your account. First, do ensure that your account details are correct and that the verification of your identity is in place. For delays or any other problems, support is available at Exness.

Exness Withdrawal Limits and Fees

Exness allows traders to withdraw funds easily, with different limits depending on the withdrawal method. The minimum withdrawal amount can vary, but generally starts at $1 for most payment methods. The maximum withdrawal amount depends on the payment provider and can range from a few thousand dollars up to much higher amounts, depending on the method used.

Minimum and Maximum Withdrawal Amounts

- Minimum Withdrawal: Typically $1 for most payment methods (e-wallets, cards).

- Maximum Withdrawal: Can vary by method, with some methods allowing up to $50,000 or more per transaction.

Be sure to check the specific limits for your chosen withdrawal method to avoid issues.

Exness Withdrawal Fees

Exness does not charge a withdrawal fee for most methods. However, some third-party payment providers may have their own charges, such as banks or e-wallet services. These fees can vary depending on the provider and the country you are withdrawing from. It’s important to confirm any fees with your payment provider to ensure you are aware of all associated costs before initiating the withdrawal.

Exness strives to keep costs low, but it’s always a good idea to double-check with your payment provider, especially for large withdrawals. Note that the processing time for withdrawals may also differ according to the method. E-wallets usually take a quick time, while bank transfers may take several business days. Always check the estimated processing time when planning your withdrawal.

Exness Common Withdrawal Issues and Solutions

When withdrawing funds from Exness, you may encounter a few common issues. These include:

- Insufficient funds in the account: Ensure your account balance is sufficient to cover the requested withdrawal.

- Payment method issues: If your selected payment method is unavailable or doesn’t support withdrawals, you may need to choose another method.

- Account verification issues: If your account is not fully verified, the withdrawal process may be delayed or rejected. Make sure all verification steps are completed.

- Bank or e-wallet restrictions: Some payment providers may impose restrictions or require additional information for withdrawals. Check with your payment provider for any specific requirements.

To resolve these issues, verify your account details, ensure sufficient funds, and double-check your payment method’s availability and restrictions. If problems persist, Exness support is available to help you quickly resolve any withdrawal issues.

Security Measures for Financial Transactions

Exness has gone to the extent of ensuring that financial transactions within the platform are secure. It has ensured that whenever a deposit or withdrawal is affected, it encrypts your information, both personal and financial. Besides, it provides 2FA authentication for further security of your account. This means that besides your password, you will require a one-time code sent to your phone or email as an additional way of logging in or confirming transactions. Besides, Exness monitors accounts for suspicious activity and, if it detects anything unusual, takes proper measures to protect your funds. It is also important to keep your login details secure and not share sensitive information to further protect your account.

Tips for Smooth Deposits and Withdrawals

To ensure smooth and hassle-free deposits and withdrawals with Exness, follow these key tips:

- Verify your account: Make sure your Exness account is fully verified before making any transactions to avoid delays.

- Choose the right payment method: Pick a payment method that works well for you, and make sure it is supported for both deposits and withdrawals.

- Double-check your payment details: Ensure your payment method details, such as card number or e-wallet information, are correct to prevent transaction errors.

- Understand the fees and limits: Be aware of any fees associated with your chosen method and check the minimum and maximum deposit/withdrawal amounts to avoid issues.

- Monitor transaction status: Keep an eye on the status of your transactions in the Exness Personal Area to quickly spot and resolve any problems.

By following these tips, you can avoid common issues and ensure your financial transactions are smooth and efficient.

Frequently Asked Questions (FAQs)

How to withdraw from Exness to a bank account?

To withdraw funds from Exness to your bank account, log in to your Exness Personal Area. Go to the “Withdraw” section, select “Bank Transfer” as the payment method, and enter the required details, including the amount. After confirmation, your withdrawal request will be processed. The funds will be transferred to your bank account after the processing time, which can vary depending on the method.